- Travel Information Manual Tim

- Iata Travel Information Manual Free Download

- Travel Information Manual (time)

- Travel Information Manual Tim

- Travel Information Manual Pdf

Travel Policy and Guidelines

The purpose of this traveler's policy guide is to help SUNY Delhi employees understand and apply the State's travel rules and regulations, to provide instructions regarding reimbursement for expenses while in travel status, and to serve as the travel requirements for the State University of New York at Delhi. The Office of the State Comptroller sets rules and regulations for the reimbursement of expenses incurred while traveling on official State business; these rules and regulations are also included by reference in collective bargaining agreements. Employees traveling on behalf of the State University are performing a valuable service; however, it is the responsibility of the employee to spend travel money as efficiently and economically as possible. When an employee travels on official State business, only actual, necessary, and reasonable business expenses will be reimbursed.

General Guidelines and Responsibilities

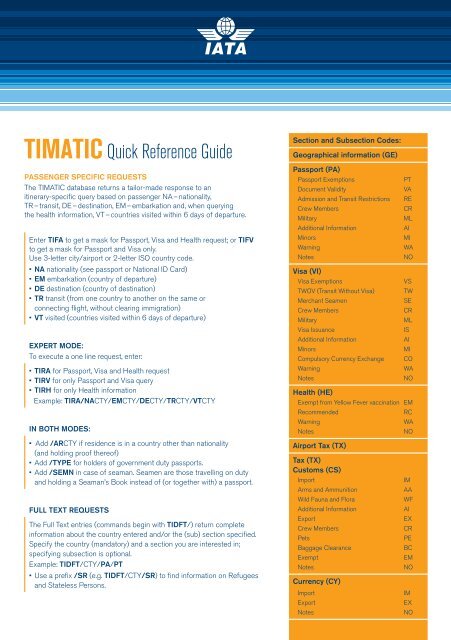

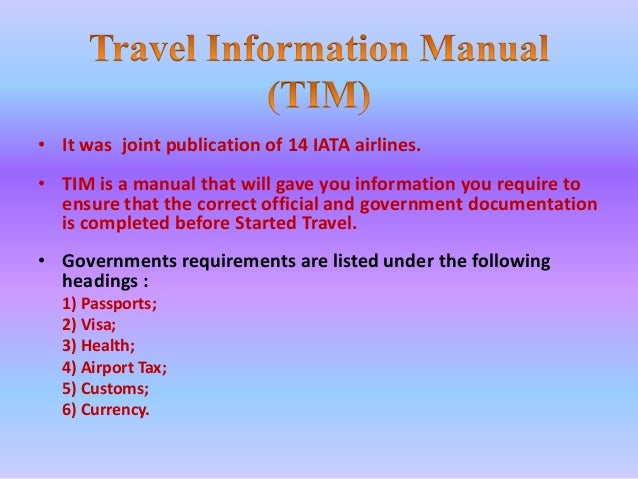

2021 Travel Information Manual (TIM) - Order Form. Start Month. Amount of TIM Manual copies. Help. Total amount (TIM Manual Unit price 279 EUR). EUR Help. The IATA Travel Centre delivers accurate passport, visa and health requirement information at a glance. One-stop shop for everything you need to know before you go When searching for travel information online, its important to know that your source is accurate, reliable and - more importantly - up-to-date. Visa requirements for Kazakhstani citizens are administrative entry restrictions by the authorities of other states placed on citizens of Kazakhstan. As of 2 July 2019, Kazakhstani citizens had visa-free or visa on arrival access to 75 countries and territories, ranking the Kazakhstani passport.

- Employees are in travel status when they are more than 35 miles from both their official station and their home (defined in the Official Station Section of this manual).

- The designation of official station will be determined by agency management in the best interest of the State and not for the convenience of the employee. The Comptroller's Office reserves the right to request justification from an agency to support its designation of official station. Official station designation relates to the position, not to the person (e.g., a full-time employee working for one agency in one position will have only one official station; a part-time employee working for two agencies in two different positions will have two official stations).

- Travel between the employee’s home and official station is considered commuting and should not be reimbursed. Reimbursing commuting costs can have significant tax consequences for the employee (please refer to the Guide to Financial Operations Chapter XIII, Section 6 for more information).

- Expense reports (e.g., Travel Voucher AC132-S) must be submitted within 30 days of the end of the travel event to account for all expenses, reimburse the traveler for out-of-pocket expenses, and reconcile the associated agency travel card charges. Employees are still required to submit expense reports to account for all expenses even if they miss the 30-day submission window.

- Agencies should check OGS contracts for the type of travel-related services available. Currently, OGS has contracts for car rentals, air travel, and centralized travel agent services, both statewide and regional. Travel agents may charge a transaction fee for various services. You can obtain more information on these contracts through the OGS web site.

The Responsibility of the Traveler is to…

- know the State and college travel rules, regulations, policies, and procedures.

- request the use of a fleet vehicle and obtain the necessary approvals before the trip.

- accurately complete and submit a Travel Request with all necessary documentation at least 10 days prior to travel, even if there is no request for reimbursement.

- know your official station and its effect on your eligibility for travel reimbursement (please visit the Guide to Financial Operations Chapter XIII, Section 6 for more information).

- verify that funding is available for reimbursement of expenses listed on the Travel Request.

- secure the most economical method of travel in the best interest of the State.

- obtain all necessary travel documents, exceptions, waivers, and justifications if expenses are beyond the normal reimbursement (e.g., tax-exempt certificate, exceeding max lodging requests, etc.).

- acquire and use a State-Issued Travel Card to minimize out-of-pocket expenses.

- maintain and include an accurate record of expenses including departure and return times, mileage, and required receipts or documentation when submitting requests and expense reports.

- submit reimbursement claims for only actual allowed expenses within reimbursement rate limits.

- correctly complete and submit a Travel Voucher AC132-S, original/itemized receipts, and other required documents to the Accounts Payable Office within 30 days of the end of the travel event.

The Responsibility of the Supervisor is to…

- know the State and college travel rules, regulations, policies, and procedures.

- know your staff's official station and its effect on their travel reimbursement.

- authorize travel only when necessary and in the best interest of the college.

- review traveler's itineraries in advance to ensure the most economical method of travel is used in the best interest of the State.

- confirm that there is sufficient funding available in the account(s) listed on the Travel Request before the request is submitted and travel occurs.

- verify that travel vouchers and reconciliation sheet amounts are within allowable rates, all required documentation is included, and that expenses are actual, reasonable, and necessary.

- review and approve expense reports in a complete and timely manner.

The Responsibility of the Agency is to…

Ensure:

- all authorized travel is in the best interest of the State.

- all expenses are actual, reasonable, and necessary.

- the most economical method of travel is used in the best interest of the State.

- compliance with Internal Revenue Service (IRS) regulations.

- the official station of each employee is designated appropriately based on the needs of each position and in the best interest of the State.

- employees obtain appropriate approvals prior to traveling, and exceptions or waivers are justified and necessary.

- all travel card charges are reconciled correctly and any/all overpayments or improper charges are recovered promptly.

- all expenses comply with the State Comptroller’s rules and regulations, this Travel Manual, the OSC Travel Manual, the Guide to Financial Operations, and policies published by oversight agencies such as the Division of the Budget (DOB), and the Governor’s Office of Employee Relations (GOER).

- original receipts are maintained in accordance with State Archives and Records Administration (SARA) guidelines in the event of an audit.

Establish:

Travel Information Manual Tim

- an agency-specific policy related to travel procedures when employees are in travel status.

- procedures to ensure accountability of cash advances and appropriate use and timely reconciliation of the travel card.

- procedures for the review and approval of employee expense reports in a complete and timely manner.

Provide:

- guidance and training to supervisors and staff in proper procedures for reimbursing travel expenses.

- a means (e.g., travel card) to minimize out-of-pocket travel expenses and control all travel-related documents (e.g., expense reports, tax exempt certificates).

Determining Travel Status

When an employee is on an assignment at a work location more than 35 miles from both their official station and their home, they are considered in travel status and are eligible for reimbursement of travel expenses in accordance with this Travel Manual. Employees must obtain appropriate approvals prior to traveling for an assignment.

Fraudulent Claims – Section 175.35 Penal Law

Offering a false instrument for filing is a Class 'E' Felony. Employees, including supervisors, who knowingly misrepresent the facts concerning travel for official business or who file or sign any travel form which contains deliberate false statements given with intent to defraud the State may be subject both to administrative and/or disciplinary action, including the possibility of termination and criminal action.

Table of Contents

Travel

TRAVEL OVERVIEW

The Travel Department is part of Payment Services in the University Controller’s office. Travel staff audits submissions for compliance with current university policies and procedures and processes payments to employees and university guests incurring travel expenses for USF business travel. Please refer to the links on these pages for relevant information, important forms and direction regarding the proper submission of requests.

TRAVEL MANUAL AND GUIDELINES

Travel Manual provides the primary rules for USF business travel.

Travel Manual

Travel Airline Class Guide

Travel Checklist

Travel Pocket Guide

FLORIDA STATUTE 112.061

Florida Statute 1001.706(6)(c) specifies that university employees are public employees for the purposes of travel and are bound by the travel requirements laid forth in F.S. 112.061. Most USF travel requirements are based, either directly or indirectly, on the provisions of 112.061.

TRAVEL COORDINATOR

The Travel Coordinator role allows access to travel transactions in Archivum, FAST and travel reports in Power BI.

The Travel Coordinator role is set up to one or multiple GEMS departments, reducing the need to request travel delegate access to each traveler as individuals are hired or leave. A department can have more than one Travel Coordinator.

Travel Coordinator access to Power BI reports helps monitor transactions until fully completed.

Two types of Travel Coordinator access available:

- Delegate capability – An enhanced Travel Coordinator role that allows users to create, submit, modify, delete, and cancel travel transactions in Archivum.

- View only – A basic Travel Coordinator role that provides view-only capabilities and will not enable submission, modification or approval of transaction.

Access may be requested by submitting the form available at link below.

HELPFUL LINKS

Iata Travel Information Manual Free Download

Out of State Purchases & Hotel Tax

US Dept. of State - Foreign Meal

Appendix B - Foreign Meal Breakdown

OANDA Currency Converter

Travel Information Manual (time)

TRAVEL FORMS

These forms are required for systems access and set up, Expense Report documentation and other processes in Travel.

FAST Access Request for Travel

Non-employee Creation Request

Delegate Assignment Request

Temporary Workflow Reassignment

Preapproval for Travel Over 30 Days

Exception to Required Receipt Form

Cash Advance Excess Funds Repayment

Travel Information Manual Tim

TRAVEL LISTSERV

Travel Information Manual Pdf

Travel Listserv is used to announce policy updates and changes to procedures to the USF business travel user community.